How To Change Spending Limit On Chase Debit Card

How to Freeze Spending on Your Card & Control Authorized User Spending

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here'due south our full advertising policy: How we brand coin.

Update: 1 or more than menu offers in this post are no longer available. Check our Hot Deals for the latest offers.

Million Mile Secrets reader, swag, asked:

What other cards offering the "Freeze it" option?

swag is referring to a tool for Discover cards that allows you to suspend business relationship activity on your cards, including authorized user cards, without closing your account completely.

And swag wants to know if other cards accept a similar choice.

I've looked into it. And I found out the bank with the all-time spending controls is really AMEX! I'll explain!

What Is Discover Freeze it?

Link: Freeze it for Discover Cards

Link:Detect it® Cash Dorsum

Link:Discover it® Miles

I wrote almost Detect'south short-term plans for its rewards cards. They'll keep a unique perk called Freeze it, which lets you "freeze" your business relationship if you temporarily misplace your card, and don't want to change your account number.

You can use Freeze it with your Find it Cash Back or Discover it Miles card.

The information for the Discover cards has been collected independently by 1000000 Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer

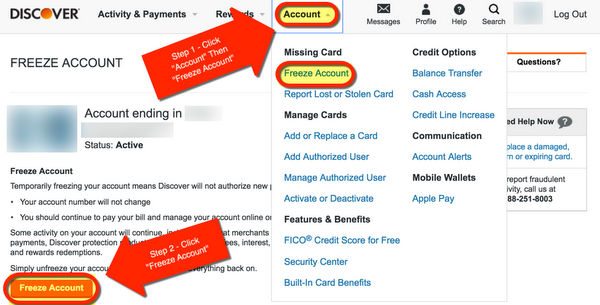

After you log-in, click " Business relationship ." Nether the drop-downwardly bill of fare choose " Freeze Account ." And so click the " Freeze Account " button. That's information technology! You can unfreeze your card merely as easily.

Freeze information technology is handy when y'all:

- Don't want new purchases authorized

- Want to protect your credit line from authorized users

- Misplaced your card and don't want information technology to get into the incorrect hands

- Want to forbid cash advances for a curt amount of time

When you apply Freeze it, your card number will Not change once you lot unfreeze. And ALL accounts linked to your Discover business relationship will be frozen, including yours and authorized users.

This is an added safeguard that tin can give yous peace of mind. And protect you lot from potential credit card fraud. Keep in mind you are NOT liable for fraudulent charges fabricated on your Discover account.

But if yous think at that place'south a chance of fraud, using Freeze it is much easier than disputing a charge and having to shut your account.

Notation that Detect still allows some transactions to post. Discover says:

Some action will proceed, including bills that merchants mark as recurring, as well as returns, credits, dispute adjustments, payments, Discover protection product fees, other business relationship fees, interest, rewards redemptions and certain other exempted transactions.

Then the major benefit to using Freeze is to prevent new transactions.

But the downside is that all cards linked to your Discover account will be frozen, including yours.

Do Other Banks Offer This?

Back to swag's question!

I called the major banks to ask if they offer a version of Freeze it, including:

- AMEX

- Bank of America

- Barclaycard

- Chase

- Citi

- United states of america Banking concern

Here's what I plant from speaking with each bank's representative.

AMEX Gives You lot the Most Control

If you want to foreclose spending on an authorized user's account without affecting your own credit line, AMEX is your all-time option.

You tin can ready controls directly on the AMEX website.

Option ane – Set Limits to $0

For personal cards, simply ready the spending limit on an authorized user'south card to $0. That way, no new charges will be canonical. Yous tin find this selection after you lot log into your AMEX account under the " Account Services " tab.

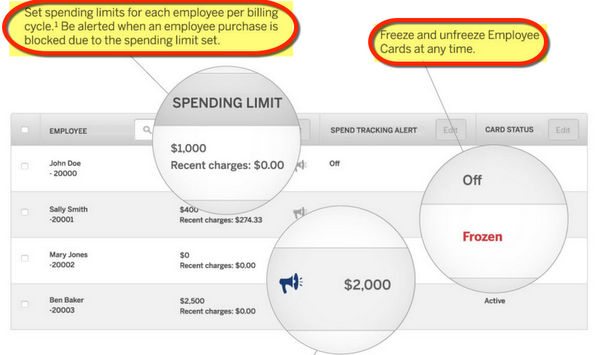

Selection 2 – Freeze Employee Cards

AMEX pocket-sized business concern cards have this same ability under the " Employee Controls " tab. You can prepare the spending limit per billing cycle.

If you want to pause purchases for a longer time, you'll besides observe an selection to "freeze" employee accounts in the same identify. This works very much like Find'southward Freeze it, except it'south just available for AMEX small business organization cards.

Between these 2 options, you'll have lots of command over an authorized user or employee'south spending limits. And, neither option affects your spending line!

For these reasons, I recall AMEX actually has meliorate "freezing" capability than Discover!

Bank of America and Hunt Small-scale Business organization Cards Allow You Gear up Limits, Too

Link: How You Might Qualify for a Small Business Credit Carte du jour

When I spoke with representatives from Bank of America and Hunt, they told me in that location was no way to set spending limits on individual authorized user cards. Because the authorized users share your credit line, so they have access to the same corporeality of credit that y'all practise.

Nonetheless, they give y'all much more control over cards attached to a pocket-size concern carte account.

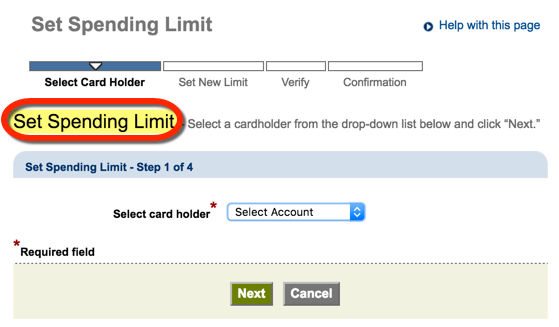

Chase lets you set the limit on their website. After yous log-in, select " Business relationship Details, " then " Set up Spending Limit ." You tin gear up the limit to $0. Or to a very small number, like $20. Any transaction over the amount yous fix volition be declined.

Banking concern of America gives you the same power with small business organisation cards, but y'all must phone call the number on the dorsum of your carte to set up the spending limit.

This is a overnice perk of having a small business concern menu with Bank of America or Hunt, like the Bank of America Alaska Airlines small business card or Chase Ink Plus.

Here'southward how you mightqualify for these cards with activities you lot already exercise!

It's Not Possible With Barclaycard, Citi, or United states of america Bank

If you have authorized users on your accounts with Barclaycard, Citi, or United states of america Bank, yous don't take many options to pause transactions on their accounts.

The only mode to prevent transactions is to report the accounts to the fraud department. But when you lot exercise that, the card will exist closed and y'all'll take to look to receive a new ane.

And because authorized users at these banks share your credit limit, if you prepare the limit to $0, you'll besides terminate any spending on your ain account.

Lesser Line

Discover cards come with Freeze it, which lets you pause new account activity for every bit long equally you want. But keep in listen, when y'all utilise this tool, it affects all accounts linked to your menu, including your ain.

The just other bank that offers a similar pick on all its cards is American Express You tin fix the spending limit on AMEX personal cards to $0, which ways whatever new transactions volition exist declined.

And you can freeze AMEX modest business cards, similar to Notice's Freeze it feature. Even better, you lot can adjust individual card limits, which makes AMEX the best bank for decision-making authorized user accounts.

Bank of America and Chase let you set the spending limit on employee cards if you lot have a pocket-sized business organization credit card. Only they don't have any similar options for personal cards.

And other banks don't have the power to command a user's spending limit without closing the carte completely.

swag, thanks for sparking the conversation with your comment! 🙂

Hunt Sapphire Preferred® Bill of fare

-

Earn 60,000 bonus points subsequently you spend $4,000 on purchases in the first three months from account opening. That's $750 when you lot redeem through Hunt Ultimate Rewards®.

-

Enjoy benefits such as a $fifty annual Ultimate Rewards Hotel Credit, 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining and 2x on all other travel purchases, plus more.

-

Get 25% more value when yous redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards®. For instance, 60,000 points are worth $750 toward travel.

-

With Pay Yourself Back(SM), your points are worth 25% more during the current offer when you redeem them for statement credits against existing purchases in select, rotating categories.

-

Count on Trip Cancellation/Interruption Insurance, Automobile Rental Collision Impairment Waiver, Lost Luggage Insurance and more.

Intro APR on purchases

N/A

Regular APR

15.99%-22.99% Variable

Balance Transfer Fee

Either $v or 5% of the corporeality of each transfer, whichever is greater.

Rates & Fees

Annual Fee $95

Other

Credit Needed Excellent / Adept

Issuer Hunt

Carte du jour Type Visa

Editorial Notation: We're the One thousand thousand Mile Secrets squad. And we're proud of our content, opinions and assay, and of our reader's comments. These haven't been reviewed, approved or endorsed by whatsoever of the airlines, hotels, or credit card issuers which we often write about. And that's just how we like information technology! :)

How To Change Spending Limit On Chase Debit Card,

Source: https://millionmilesecrets.com/guides/how-to-freeze-spending-on-your-card-control-authorized-user-spending/

Posted by: hectorrusequithe.blogspot.com

0 Response to "How To Change Spending Limit On Chase Debit Card"

Post a Comment